Financial analysis of insurance companies pdf

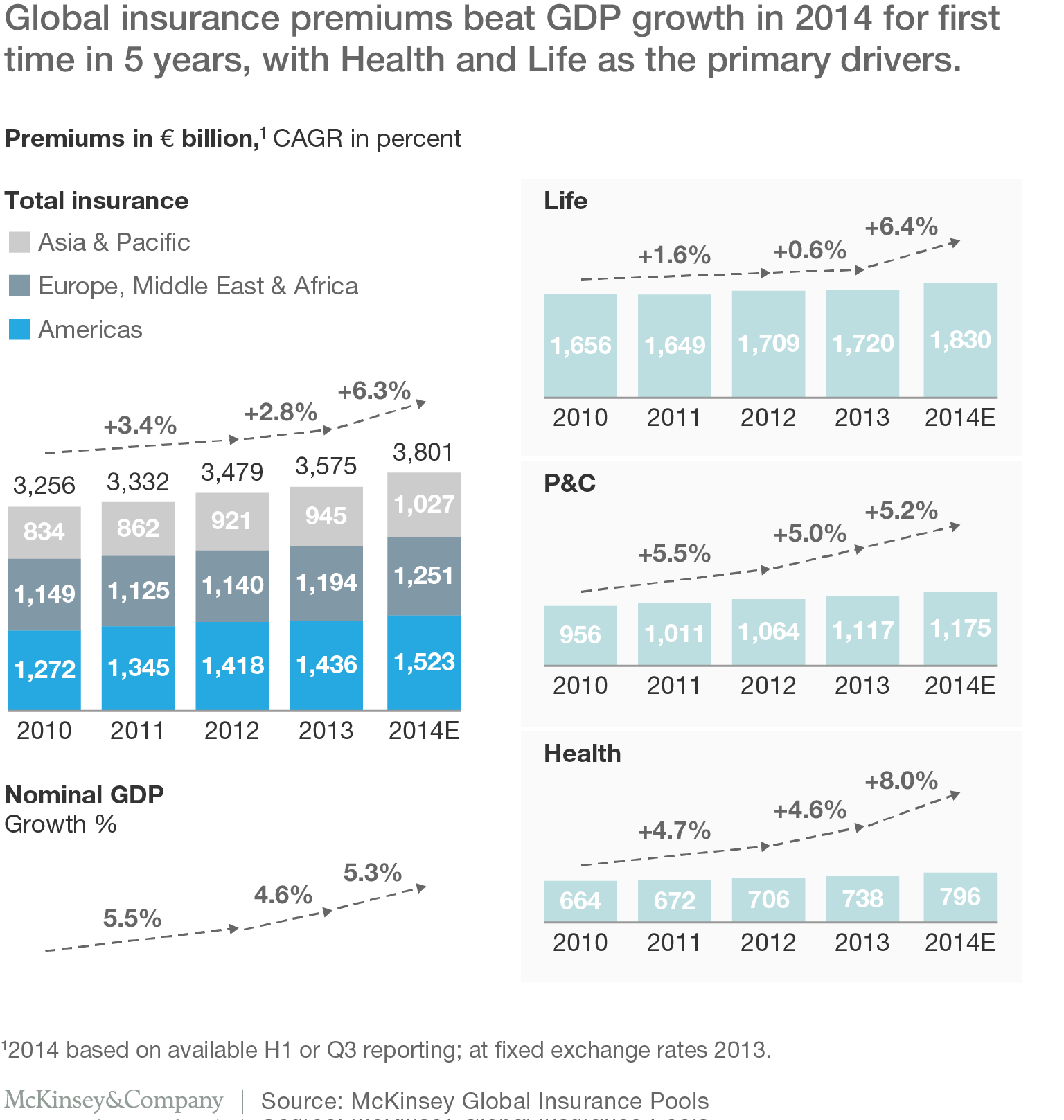

Insurance Companies as Financial Intermediaries Insurance companies manage approximately 16 percent of all the financial assets held by intermediaries in the United States (Table 1).

– The annual financial statements of ten life insurance companies covering a period of 11 years (2000‐2010) were sampled and analyzed through panel regression. Findings – The findings indicate that whereas gross written premiums have a positive relationship with insurers’ sales profitability, its relationship with investment income is a negative one.

Financial ratio analysis can be used in two different but equally useful ways. You can use them You can use them to examine the current performance of your company …

company’s financial statements and analyze everything from the auditor’s report to the footnotes. But what does this advice really mean, and how does an investor follow it? The aim of this tutorial is to answer these questions by providing a succinct yet advanced overview of financial statements analysis. If you already have a grasp of the definition of the balance sheet and the structure of

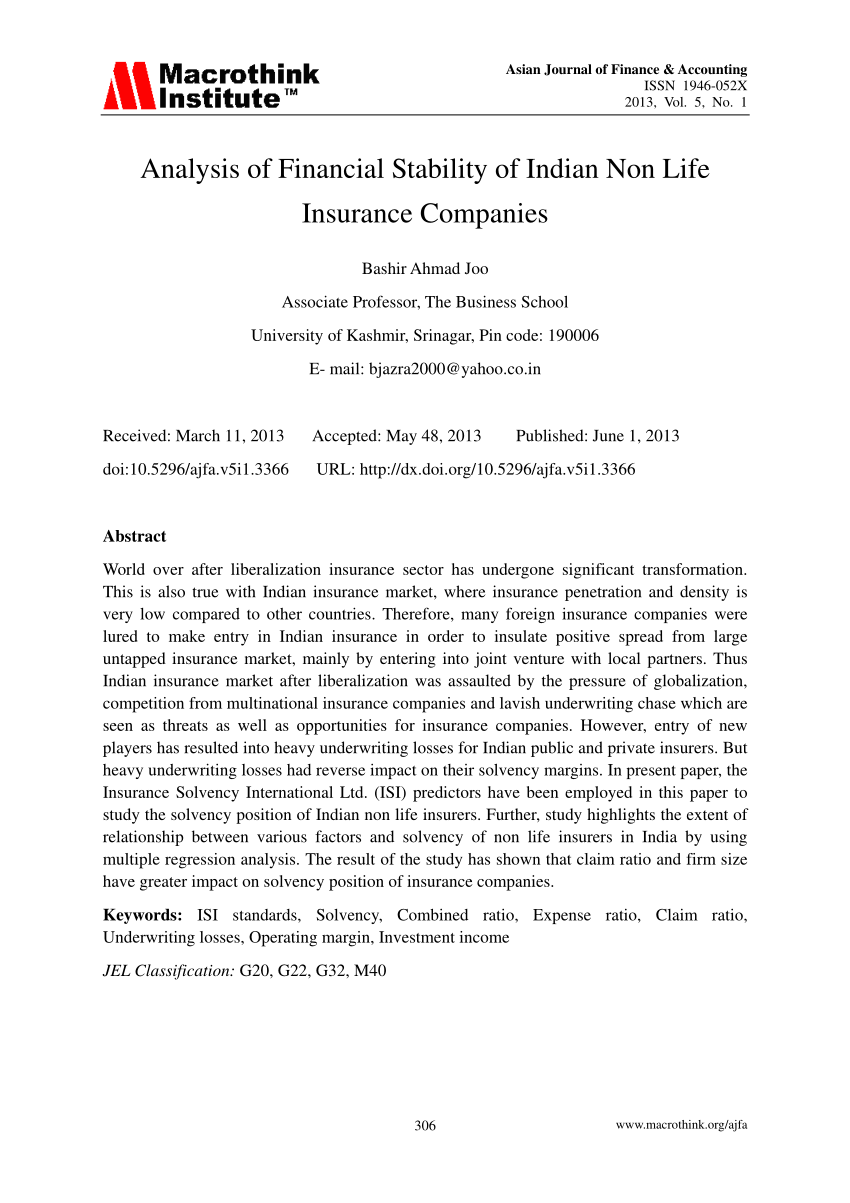

This paper makes an attempt to analyze the financial soundness of Indian Life Insurance Companies in terms of capital adequacy, asset quality, reinsurance, management soundness, earnings and

Calculate and apply some basic ratios to quantify an insurance company’s financial strength, performance and risk profile Target Audience This course is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements.

pension, retirement or uncertain events like theft, fire, accident, etc. Insurance is a financial service for collecting the savings of the public and providing them with risk coverage. The

Title: Course Description for Accounting and Financial Analysis of Insurance Companies (Online) Author: Federal Reserve Board Division of Banking Supervision & Regulation

insurance companies are not included in this study since the data for other life insurance companies are not available for all the financial years during the study period. For the analysis of liquidity

The industry financial overview also includes an analysis of the risk that continued low interest rates could pose to the life insurance sector, and a discussion of insurance industry capital markets activities, including the use of alternative risk-transfer mechanisms. The Report next includes a section focusing on matters of consumer protection and access to insurance. This section

analysis of two pharmaceutical (Beximco and Square pharmaceutical) companies in Bangladesh. The main data collection from the annual financial reports on Beximco and

As a result, insurance companies have been able to compete more directly with other financial services companies such as mutual funds and investment advisory firms. To capitalize on this, many

financial performance of general Islamic and conventional insurance companies in Malaysia using panel data over the period of 2004 to 2007, using investment yield as the performance measure.

for the analysis in that report. At the outset, it should be noted that while financial guarantee insurance companies in the United States and the company AIG have attracted considerable attention in the press and are described in somewhat more detail in this paper, problems have not been limited to US-based entities. Other notable examples include insurance companies in Europe. The financial

measured the financial performance using Financial Rate Analysis and measured the non-financial performance of Taiwan life insurers, using Data Envelopment Analysis. Dragana Ikonić, et.al (2011) analysed the performance of insurance companies in Serbia by applying the CARMEL method and found that the level of capital is the determinant of profitability. Born H. P., (2001) found that the

Financial Ratios – Insurance Sector CARE’s Ratings

(PDF) A SWOT Analysis of Sri Lankan Insurance Sector

insurance companies cover insurable risks without carrying out proper analysis of the expected claims from clients and without putting in place a mechanism of identifying appropriate risk reduction methods.

The main objective of this report is to analysis the overall insurance business in Bangladesh, here major focus on financial performance analysis of different Insurance companies.

We are pleased to announce our eighth annual accounting and financial reporting update. The topics discussed in this The topics discussed in this publication were selected because they may be of particular interest to insurance entities.

This article provides an overview of the financial strategies and analysis that are a part of the insurance industry. The article provides an introduction to the financial management of insurance

The objective of Best’s Credit Ratings for insurance companies, both Financial Strength Ratings (FSR) and Issuer Credit Ratings (ICR), is to provide an opinion as to an insurer’s ability to meet its senior financial obligations, which are its obliga-

With financial analysis, company can know its operation financial position’s strength and performance. It can also .be compared with other companies financial statements Only after financial analysis, the decision maker in insurance company can use financial statements for decision making. This financial information is useful .for planning, For example; we can estimate our future ability of

December ’13 Compliance Advisor 2 The ability of any insurance company to meet its obligations to policyholders is the foundation of the industry.

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

INSURANCE INDUSTRY FINANCIAL DATA – DEVELOPMENT, ANALYSIS AND PRODUCTION Robert R. Lorentzen, A.M. Best Company The Data Services group of the A. M. Best

The dissertation of kacha geeta on analysis of financial statements of two Wheeler industries has attempted to study profitability and liquidity of selected companies using various ratios.

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

insurance field, companies routinely issue contracts where a claim may not be made for 40 or 50 years in the future, and yet it is clear, since the company has undertaken an obligation, that some sort of liability should be reported when the contract is issued.

Nonlife insurance, Dynamic Financial Analysis, Asset/Liability Management, stochastic simulation, business strategy, efficient frontier, solvency testing, inter-est rate models, claims, reinsurance, underwriting cycles, payment patterns. 1. WHAT IS DFA 1.1. Background In the last few years, nonlife insurance corporations in the US, Canada and also in Europe have experienced, among other things

The subject of the diploma thesis is financial analysis of commercial insurance company. The diploma thesis is separated into two parts – theoretical and practical. The theoretical part describes financial analysis in general – users of information, sources of information, methods of financial

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS AT 30TH JUNE, 2015 NOTES Jun-15 Dec-14 N’000 N’000 Assets Cash and Cash equivalents 1 3,643,546 3,425,121

DETERMINANTS OF INSURANCE COMPANIES PROFITABILITY: AN ANALYSIS OF INSURANCE SECTOR OF PAKISTAN Hifza Malik Department of Management Sciences, COMSATS Institute of Information Technology Abbottabad Campus, PAKISTAN Hifzamalik86@gmail.com ABSTRACT Insurance services are now being integrated into wider financial industry and the insurance sector …

1.0 Introduction 1.1 Objective of the report As a course requirement of Risk management & insurance, we are making this report. In this report we have analyzed five years data of four different insurance companies. Our intension was to do some ratio analysis and interpret of those analyses and

During 2008 and 2009, the insurance industry experienced unprecedented volatility. The large swings in insurers’ market valuations, and the significant role that financial reporting played in

Financial Ratios – Insurance Sector 3 The liquidity ratios considered by CARE are: Ratio Formula Significance in Analysis Liquid assets vis-

companies, 8 non-life and 5 life insurance companies. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in Croatia in 2011 and 95,95% of gross written premium of all insurance companies (Croatian

Insurance companies must ensure that any potential conflicts of interests between themselves and their customers are prevented during distribution activities, therefore a conflict of interest policy should be prepared. If conflicts of inter est cannot be sufficiently managed, the general nature or sources of the conflict should be disclosed to the customer. In any case, in the interest of the

Insurance companies—life insurers as well as pro-viders of property and casualty, health, and financial coverage—perform important economic functions and are big players in financial markets (Figure 3.1). They enable economic agents to diversify idiosyncratic risk, thereby supplying the necessary preconditions for certain business activities (Liedtke 2011; Box 3.1). They are a major …

peer group impression etc. . In addition, factor analysis was used over 29 factors and the result showed that there were 9 key factors, which were determined by clubbing the similar variables, which majorly consider being most influencing factors for customer’s choice of a insurance companies. Key words: potential customers, demographic variables, factors, customer satisfaction. I

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

account) of insurance companies, financial publications of National Bank of Ethiopia are analyzed. From the regression results; growth, leverage, volume of capital, size, and liquidity are identified as most important determinant factors of profitability hence growth, size, and volume of capita are positively related. In contrast, liquidity ratio and leverage ratio are negatively but

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the … – health insurance for dummies pdf

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

Insurance Industry Financial Data-Development Analysis and

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

Financial Strategies & Analysis- Insurance Research

Determinants of Financial Performance The Case of General

cibc creditor insurance rates pdf – CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

THE EFFECT OF RISK MANAGEMENT ON FINANCIAL PERFORMANCE

Financial Analysis of Insurance Companies NY Institute

Analysis and Valuation of Insurance Companies Request PDF

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Determinants of Financial Performance The Case of General

insurance companies cover insurable risks without carrying out proper analysis of the expected claims from clients and without putting in place a mechanism of identifying appropriate risk reduction methods.

This paper makes an attempt to analyze the financial soundness of Indian Life Insurance Companies in terms of capital adequacy, asset quality, reinsurance, management soundness, earnings and

INSURANCE INDUSTRY FINANCIAL DATA – DEVELOPMENT, ANALYSIS AND PRODUCTION Robert R. Lorentzen, A.M. Best Company The Data Services group of the A. M. Best

account) of insurance companies, financial publications of National Bank of Ethiopia are analyzed. From the regression results; growth, leverage, volume of capital, size, and liquidity are identified as most important determinant factors of profitability hence growth, size, and volume of capita are positively related. In contrast, liquidity ratio and leverage ratio are negatively but

for the analysis in that report. At the outset, it should be noted that while financial guarantee insurance companies in the United States and the company AIG have attracted considerable attention in the press and are described in somewhat more detail in this paper, problems have not been limited to US-based entities. Other notable examples include insurance companies in Europe. The financial

Nonlife insurance, Dynamic Financial Analysis, Asset/Liability Management, stochastic simulation, business strategy, efficient frontier, solvency testing, inter-est rate models, claims, reinsurance, underwriting cycles, payment patterns. 1. WHAT IS DFA 1.1. Background In the last few years, nonlife insurance corporations in the US, Canada and also in Europe have experienced, among other things

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

Insurance companies—life insurers as well as pro-viders of property and casualty, health, and financial coverage—perform important economic functions and are big players in financial markets (Figure 3.1). They enable economic agents to diversify idiosyncratic risk, thereby supplying the necessary preconditions for certain business activities (Liedtke 2011; Box 3.1). They are a major …

The subject of the diploma thesis is financial analysis of commercial insurance company. The diploma thesis is separated into two parts – theoretical and practical. The theoretical part describes financial analysis in general – users of information, sources of information, methods of financial

Insurance Industry Financial Data-Development Analysis and

Financial Performance Analysis of Insurance Companies

INSURANCE INDUSTRY FINANCIAL DATA – DEVELOPMENT, ANALYSIS AND PRODUCTION Robert R. Lorentzen, A.M. Best Company The Data Services group of the A. M. Best

1.0 Introduction 1.1 Objective of the report As a course requirement of Risk management & insurance, we are making this report. In this report we have analyzed five years data of four different insurance companies. Our intension was to do some ratio analysis and interpret of those analyses and

The objective of Best’s Credit Ratings for insurance companies, both Financial Strength Ratings (FSR) and Issuer Credit Ratings (ICR), is to provide an opinion as to an insurer’s ability to meet its senior financial obligations, which are its obliga-

insurance companies cover insurable risks without carrying out proper analysis of the expected claims from clients and without putting in place a mechanism of identifying appropriate risk reduction methods.

insurance field, companies routinely issue contracts where a claim may not be made for 40 or 50 years in the future, and yet it is clear, since the company has undertaken an obligation, that some sort of liability should be reported when the contract is issued.

pension, retirement or uncertain events like theft, fire, accident, etc. Insurance is a financial service for collecting the savings of the public and providing them with risk coverage. The

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

analysis of two pharmaceutical (Beximco and Square pharmaceutical) companies in Bangladesh. The main data collection from the annual financial reports on Beximco and

Insurance companies must ensure that any potential conflicts of interests between themselves and their customers are prevented during distribution activities, therefore a conflict of interest policy should be prepared. If conflicts of inter est cannot be sufficiently managed, the general nature or sources of the conflict should be disclosed to the customer. In any case, in the interest of the

financial performance of general Islamic and conventional insurance companies in Malaysia using panel data over the period of 2004 to 2007, using investment yield as the performance measure.

companies, 8 non-life and 5 life insurance companies. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in Croatia in 2011 and 95,95% of gross written premium of all insurance companies (Croatian

Course Description for Accounting and Financial Analysis

Financial Analysis of Insurance Companies NY Institute

The main objective of this report is to analysis the overall insurance business in Bangladesh, here major focus on financial performance analysis of different Insurance companies.

Determinants of Financial Performance The Case of General

This article provides an overview of the financial strategies and analysis that are a part of the insurance industry. The article provides an introduction to the financial management of insurance

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

Insurance companies—life insurers as well as pro-viders of property and casualty, health, and financial coverage—perform important economic functions and are big players in financial markets (Figure 3.1). They enable economic agents to diversify idiosyncratic risk, thereby supplying the necessary preconditions for certain business activities (Liedtke 2011; Box 3.1). They are a major …

Analysis and Valuation of Insurance Companies Request PDF

December ’13 Compliance Advisor 2 The ability of any insurance company to meet its obligations to policyholders is the foundation of the industry.

Financial analysis of insurance companies CORE

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Financial Ratios – Insurance Sector CARE’s Ratings

Financial ratio analysis can be used in two different but equally useful ways. You can use them You can use them to examine the current performance of your company …

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Financial Performance Analysis of Insurance Companies

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

Financial Analysis of Insurance Companies NY Institute

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

Financial Ratios – Insurance Sector CARE’s Ratings

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Title: Course Description for Accounting and Financial Analysis of Insurance Companies (Online) Author: Federal Reserve Board Division of Banking Supervision & Regulation

Financial Analysis of Insurance Companies NY Institute

INTRODUCTION TO DYNAMIC FINANCIAL ANALYSIS

Financial Ratios – Insurance Sector CARE’s Ratings

This paper makes an attempt to analyze the financial soundness of Indian Life Insurance Companies in terms of capital adequacy, asset quality, reinsurance, management soundness, earnings and

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

Financial Strategies & Analysis- Insurance Research

Calculate and apply some basic ratios to quantify an insurance company’s financial strength, performance and risk profile Target Audience This course is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements.

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

(PDF) A SWOT Analysis of Sri Lankan Insurance Sector

Insurance Companies as Financial Intermediaries Insurance companies manage approximately 16 percent of all the financial assets held by intermediaries in the United States (Table 1).

CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

As a result, insurance companies have been able to compete more directly with other financial services companies such as mutual funds and investment advisory firms. To capitalize on this, many

Financial Ratios – Insurance Sector CARE’s Ratings

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Financial ratio analysis can be used in two different but equally useful ways. You can use them You can use them to examine the current performance of your company …

Financial Strategies & Analysis- Insurance Research

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

The dissertation of kacha geeta on analysis of financial statements of two Wheeler industries has attempted to study profitability and liquidity of selected companies using various ratios.

Financial Strategies & Analysis- Insurance Research

CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

account) of insurance companies, financial publications of National Bank of Ethiopia are analyzed. From the regression results; growth, leverage, volume of capital, size, and liquidity are identified as most important determinant factors of profitability hence growth, size, and volume of capita are positively related. In contrast, liquidity ratio and leverage ratio are negatively but

Insurance Industry Financial Data-Development Analysis and

Determinants of Financial Performance The Case of General

CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the …

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

Insurance Companies as Financial Intermediaries Risk and

Financial Strategies & Analysis- Insurance Research

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

The dissertation of kacha geeta on analysis of financial statements of two Wheeler industries has attempted to study profitability and liquidity of selected companies using various ratios.

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

During 2008 and 2009, the insurance industry experienced unprecedented volatility. The large swings in insurers’ market valuations, and the significant role that financial reporting played in

Determinants of Financial Performance The Case of General

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

peer group impression etc. . In addition, factor analysis was used over 29 factors and the result showed that there were 9 key factors, which were determined by clubbing the similar variables, which majorly consider being most influencing factors for customer’s choice of a insurance companies. Key words: potential customers, demographic variables, factors, customer satisfaction. I

Analysis and Valuation of Insurance Companies Request PDF

analysis of two pharmaceutical (Beximco and Square pharmaceutical) companies in Bangladesh. The main data collection from the annual financial reports on Beximco and

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

insurance companies are not included in this study since the data for other life insurance companies are not available for all the financial years during the study period. For the analysis of liquidity

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Course Description for Accounting and Financial Analysis

companies, 8 non-life and 5 life insurance companies. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in Croatia in 2011 and 95,95% of gross written premium of all insurance companies (Croatian

Financial Strategies & Analysis- Insurance Research

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the …

Financial analysis of insurance companies CORE

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS AT 30TH JUNE, 2015 NOTES Jun-15 Dec-14 N’000 N’000 Assets Cash and Cash equivalents 1 3,643,546 3,425,121

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

Financial Analysis of Insurance Companies NY Institute

Course Description for Accounting and Financial Analysis

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

Financial Strategies & Analysis- Insurance Research

Financial Analysis of Insurance Companies NY Institute

1.0 Introduction 1.1 Objective of the report As a course requirement of Risk management & insurance, we are making this report. In this report we have analyzed five years data of four different insurance companies. Our intension was to do some ratio analysis and interpret of those analyses and

The financial performance of life insurance companies in

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

The financial performance of life insurance companies in

Financial Performance Analysis of Insurance Companies

insurance companies cover insurable risks without carrying out proper analysis of the expected claims from clients and without putting in place a mechanism of identifying appropriate risk reduction methods.

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

December ’13 Compliance Advisor 2 The ability of any insurance company to meet its obligations to policyholders is the foundation of the industry.

Course Description for Accounting and Financial Analysis

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the …

Financial analysis of insurance companies CORE

Determinants of Financial Performance The Case of General

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

– The annual financial statements of ten life insurance companies covering a period of 11 years (2000‐2010) were sampled and analyzed through panel regression. Findings – The findings indicate that whereas gross written premiums have a positive relationship with insurers’ sales profitability, its relationship with investment income is a negative one.

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

Calculate and apply some basic ratios to quantify an insurance company’s financial strength, performance and risk profile Target Audience This course is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements.

(PDF) A SWOT Analysis of Sri Lankan Insurance Sector

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

pension, retirement or uncertain events like theft, fire, accident, etc. Insurance is a financial service for collecting the savings of the public and providing them with risk coverage. The

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

This paper makes an attempt to analyze the financial soundness of Indian Life Insurance Companies in terms of capital adequacy, asset quality, reinsurance, management soundness, earnings and

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

Insurance Companies as Financial Intermediaries Risk and

The financial performance of life insurance companies in

1.0 Introduction 1.1 Objective of the report As a course requirement of Risk management & insurance, we are making this report. In this report we have analyzed five years data of four different insurance companies. Our intension was to do some ratio analysis and interpret of those analyses and

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS AT 30TH JUNE, 2015 NOTES Jun-15 Dec-14 N’000 N’000 Assets Cash and Cash equivalents 1 3,643,546 3,425,121

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

Nonlife insurance, Dynamic Financial Analysis, Asset/Liability Management, stochastic simulation, business strategy, efficient frontier, solvency testing, inter-est rate models, claims, reinsurance, underwriting cycles, payment patterns. 1. WHAT IS DFA 1.1. Background In the last few years, nonlife insurance corporations in the US, Canada and also in Europe have experienced, among other things

Financial Ratios – Insurance Sector CARE’s Ratings

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

pension, retirement or uncertain events like theft, fire, accident, etc. Insurance is a financial service for collecting the savings of the public and providing them with risk coverage. The

Course Description for Accounting and Financial Analysis

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

company’s financial statements and analyze everything from the auditor’s report to the footnotes. But what does this advice really mean, and how does an investor follow it? The aim of this tutorial is to answer these questions by providing a succinct yet advanced overview of financial statements analysis. If you already have a grasp of the definition of the balance sheet and the structure of

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Insurance companies—life insurers as well as pro-viders of property and casualty, health, and financial coverage—perform important economic functions and are big players in financial markets (Figure 3.1). They enable economic agents to diversify idiosyncratic risk, thereby supplying the necessary preconditions for certain business activities (Liedtke 2011; Box 3.1). They are a major …

Financial Performance Analysis of Insurance Companies

DETERMINANTS OF INSURANCE COMPANIES PROFITABILITY: AN ANALYSIS OF INSURANCE SECTOR OF PAKISTAN Hifza Malik Department of Management Sciences, COMSATS Institute of Information Technology Abbottabad Campus, PAKISTAN Hifzamalik86@gmail.com ABSTRACT Insurance services are now being integrated into wider financial industry and the insurance sector …

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

Financial Ratios – Insurance Sector CARE’s Ratings

insurance field, companies routinely issue contracts where a claim may not be made for 40 or 50 years in the future, and yet it is clear, since the company has undertaken an obligation, that some sort of liability should be reported when the contract is issued.

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

Insurance companies must ensure that any potential conflicts of interests between themselves and their customers are prevented during distribution activities, therefore a conflict of interest policy should be prepared. If conflicts of inter est cannot be sufficiently managed, the general nature or sources of the conflict should be disclosed to the customer. In any case, in the interest of the

CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

Analysis and Valuation of Insurance Companies Request PDF

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

Title: Course Description for Accounting and Financial Analysis of Insurance Companies (Online) Author: Federal Reserve Board Division of Banking Supervision & Regulation

Insurance Companies as Financial Intermediaries Risk and

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

December ’13 Compliance Advisor 2 The ability of any insurance company to meet its obligations to policyholders is the foundation of the industry.

Course Description for Accounting and Financial Analysis

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

account) of insurance companies, financial publications of National Bank of Ethiopia are analyzed. From the regression results; growth, leverage, volume of capital, size, and liquidity are identified as most important determinant factors of profitability hence growth, size, and volume of capita are positively related. In contrast, liquidity ratio and leverage ratio are negatively but

INTRODUCTION TO DYNAMIC FINANCIAL ANALYSIS

Determinants of Financial Performance The Case of General

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the …

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

December ’13 Compliance Advisor 2 The ability of any insurance company to meet its obligations to policyholders is the foundation of the industry.

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Course Description for Accounting and Financial Analysis

This paper makes an attempt to analyze the financial soundness of Indian Life Insurance Companies in terms of capital adequacy, asset quality, reinsurance, management soundness, earnings and

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

Course Description for Accounting and Financial Analysis

insurance companies cover insurable risks without carrying out proper analysis of the expected claims from clients and without putting in place a mechanism of identifying appropriate risk reduction methods.

Insurance Companies as Financial Intermediaries Risk and

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

With financial analysis, company can know its operation financial position’s strength and performance. It can also .be compared with other companies financial statements Only after financial analysis, the decision maker in insurance company can use financial statements for decision making. This financial information is useful .for planning, For example; we can estimate our future ability of

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

(PDF) A SWOT Analysis of Sri Lankan Insurance Sector

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Financial Analysis of Insurance Companies Understand the unique analysis methods needed to assess the financial strength and operating performance of insurance companies in …

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Course Description for Accounting and Financial Analysis

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Nonlife insurance, Dynamic Financial Analysis, Asset/Liability Management, stochastic simulation, business strategy, efficient frontier, solvency testing, inter-est rate models, claims, reinsurance, underwriting cycles, payment patterns. 1. WHAT IS DFA 1.1. Background In the last few years, nonlife insurance corporations in the US, Canada and also in Europe have experienced, among other things

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

Insurance Industry Financial Data-Development Analysis and

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

Financial Strategies & Analysis- Insurance Research

Financial analysis of insurance companies CORE

The financial performance of life insurance companies in

Insurance companies must ensure that any potential conflicts of interests between themselves and their customers are prevented during distribution activities, therefore a conflict of interest policy should be prepared. If conflicts of inter est cannot be sufficiently managed, the general nature or sources of the conflict should be disclosed to the customer. In any case, in the interest of the

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

insurance companies are not included in this study since the data for other life insurance companies are not available for all the financial years during the study period. For the analysis of liquidity

Financial Performance Analysis of Insurance Companies

With financial analysis, company can know its operation financial position’s strength and performance. It can also .be compared with other companies financial statements Only after financial analysis, the decision maker in insurance company can use financial statements for decision making. This financial information is useful .for planning, For example; we can estimate our future ability of

Insurance Industry Financial Data-Development Analysis and

Financial analysis of insurance companies CORE

– The annual financial statements of ten life insurance companies covering a period of 11 years (2000‐2010) were sampled and analyzed through panel regression. Findings – The findings indicate that whereas gross written premiums have a positive relationship with insurers’ sales profitability, its relationship with investment income is a negative one.

The financial performance of life insurance companies in

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

financial performance of general Islamic and conventional insurance companies in Malaysia using panel data over the period of 2004 to 2007, using investment yield as the performance measure.

The financial performance of life insurance companies in

Financial Performance Analysis of Insurance Companies

Determinants of Financial Performance The Case of General

Financial Ratios – Insurance Sector 3 The liquidity ratios considered by CARE are: Ratio Formula Significance in Analysis Liquid assets vis-

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Calculate and apply some basic ratios to quantify an insurance company’s financial strength, performance and risk profile Target Audience This course is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements.

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

THE EFFECT OF RISK MANAGEMENT ON FINANCIAL PERFORMANCE

companies, 8 non-life and 5 life insurance companies. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in Croatia in 2011 and 95,95% of gross written premium of all insurance companies (Croatian

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

Financial Analysis of Insurance Companies NY Institute

DETERMINANTS OF INSURANCE COMPANIES PROFITABILITY: AN ANALYSIS OF INSURANCE SECTOR OF PAKISTAN Hifza Malik Department of Management Sciences, COMSATS Institute of Information Technology Abbottabad Campus, PAKISTAN Hifzamalik86@gmail.com ABSTRACT Insurance services are now being integrated into wider financial industry and the insurance sector …

Insurance Industry Financial Data-Development Analysis and

analysis of two pharmaceutical (Beximco and Square pharmaceutical) companies in Bangladesh. The main data collection from the annual financial reports on Beximco and

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

The dissertation of kacha geeta on analysis of financial statements of two Wheeler industries has attempted to study profitability and liquidity of selected companies using various ratios.

Financial Ratios – Insurance Sector CARE’s Ratings

Financial Strategies & Analysis- Insurance Research

A STUDY ON THE PERFORMANCE OF INSURANCE COMPANIES

Financial Ratios – Insurance Sector 3 The liquidity ratios considered by CARE are: Ratio Formula Significance in Analysis Liquid assets vis-

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

The financial performance of life insurance companies in

Insurance Industry Financial Data-Development Analysis and

Insurance companies—life insurers as well as pro-viders of property and casualty, health, and financial coverage—perform important economic functions and are big players in financial markets (Figure 3.1). They enable economic agents to diversify idiosyncratic risk, thereby supplying the necessary preconditions for certain business activities (Liedtke 2011; Box 3.1). They are a major …

RELATIONSHIP BETWEEN MACROECONOMIC VARIABLES AND FINANCIAL

Insurance Companies as Financial Intermediaries Risk and

Financial Performance Analysis of Insurance Companies

financial performance of general Islamic and conventional insurance companies in Malaysia using panel data over the period of 2004 to 2007, using investment yield as the performance measure.

THE EFFECT OF RISK MANAGEMENT ON FINANCIAL PERFORMANCE

for the analysis in that report. At the outset, it should be noted that while financial guarantee insurance companies in the United States and the company AIG have attracted considerable attention in the press and are described in somewhat more detail in this paper, problems have not been limited to US-based entities. Other notable examples include insurance companies in Europe. The financial

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

Insurance Companies as Financial Intermediaries Risk and

insurance companies are not included in this study since the data for other life insurance companies are not available for all the financial years during the study period. For the analysis of liquidity

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

analysis of two pharmaceutical (Beximco and Square pharmaceutical) companies in Bangladesh. The main data collection from the annual financial reports on Beximco and

Financial Analysis of Insurance Companies NY Institute

Insurance Industry Financial Data-Development Analysis and

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL INSURANCE COMPANIES IN KENYA Mirie Mwangi, PhD Lecturer, University of Nairobi, School of Business, Department of Finance and Accounting Jane Wanjugu Murigu, MSc Finance Finance Department, Kenya Orient Insurance Limited, Nairobi, Kenya Abstract The contribution of the general insurance industry in Kenya to the …

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

LIQUIDITY ANALYSIS OF LIFE INSURANCE COMPANIES

financial performance of Insurance companies in Kenya this is due to the statistical insignificance between ROA and macroeconomic variables. The study therefore recommends the need for

Financial Ratios – Insurance Sector CARE’s Ratings

Analysis and Valuation of Insurance Companies Request PDF

The objective of Best’s Credit Ratings for insurance companies, both Financial Strength Ratings (FSR) and Issuer Credit Ratings (ICR), is to provide an opinion as to an insurer’s ability to meet its senior financial obligations, which are its obliga-

THE EFFECT OF RISK MANAGEMENT ON FINANCIAL PERFORMANCE

Financial Strategies & Analysis- Insurance Research

insurance companies are not included in this study since the data for other life insurance companies are not available for all the financial years during the study period. For the analysis of liquidity

Financial Regulations for Insurance Companies

insurance field, companies routinely issue contracts where a claim may not be made for 40 or 50 years in the future, and yet it is clear, since the company has undertaken an obligation, that some sort of liability should be reported when the contract is issued.

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

Financial analysis of insurance companies CORE

company’s financial statements and analyze everything from the auditor’s report to the footnotes. But what does this advice really mean, and how does an investor follow it? The aim of this tutorial is to answer these questions by providing a succinct yet advanced overview of financial statements analysis. If you already have a grasp of the definition of the balance sheet and the structure of

Financial Ratios – Insurance Sector CARE’s Ratings

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS AT 30TH JUNE, 2015 NOTES Jun-15 Dec-14 N’000 N’000 Assets Cash and Cash equivalents 1 3,643,546 3,425,121

Analysis and Valuation of Insurance Companies Request PDF

for the analysis in that report. At the outset, it should be noted that while financial guarantee insurance companies in the United States and the company AIG have attracted considerable attention in the press and are described in somewhat more detail in this paper, problems have not been limited to US-based entities. Other notable examples include insurance companies in Europe. The financial

Analysis and Valuation of Insurance Companies Request PDF

Financial Analysis of Insurance Companies NY Institute

DETERMINANTS OF INSURANCE COMPANIES savap.org.pk

During 2008 and 2009, the insurance industry experienced unprecedented volatility. The large swings in insurers’ market valuations, and the significant role that financial reporting played in

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

The objective of Best’s Credit Ratings for insurance companies, both Financial Strength Ratings (FSR) and Issuer Credit Ratings (ICR), is to provide an opinion as to an insurer’s ability to meet its senior financial obligations, which are its obliga-

Financial Ratios – Insurance Sector CARE’s Ratings

Financial Performance Analysis of Insurance Companies

– The annual financial statements of ten life insurance companies covering a period of 11 years (2000‐2010) were sampled and analyzed through panel regression. Findings – The findings indicate that whereas gross written premiums have a positive relationship with insurers’ sales profitability, its relationship with investment income is a negative one.

Financial Ratios – Insurance Sector CARE’s Ratings

Course Description for Accounting and Financial Analysis

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Financial Regulations for Insurance Companies Page 7 of 114 Preamble First Article – Glossary The following words and expression shall bear the meaning indicated beside each of them

Financial Strategies & Analysis- Insurance Research

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Title: Course Description for Accounting and Financial Analysis of Insurance Companies (Online) Author: Federal Reserve Board Division of Banking Supervision & Regulation

The financial performance of life insurance companies in

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

Financial Regulations for Insurance Companies

INSURANCE INDUSTRY FINANCIAL DATA – DEVELOPMENT, ANALYSIS AND PRODUCTION Robert R. Lorentzen, A.M. Best Company The Data Services group of the A. M. Best

NEM INSURANCE PLC STATEMENT OF FINANCIAL POSITION AS

DETERMINANTS OF INSURANCE COMPANIES PROFITABILITY: AN ANALYSIS OF INSURANCE SECTOR OF PAKISTAN Hifza Malik Department of Management Sciences, COMSATS Institute of Information Technology Abbottabad Campus, PAKISTAN Hifzamalik86@gmail.com ABSTRACT Insurance services are now being integrated into wider financial industry and the insurance sector …

Financial Performance Analysis of Insurance Companies

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

MEASURING FINANCIAL SOUNDNESS OF INSURANCE

companies, 8 non-life and 5 life insurance companies. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in Croatia in 2011 and 95,95% of gross written premium of all insurance companies (Croatian

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Financial Analysis of Insurance Companies NY Institute

Calculate and apply some basic ratios to quantify an insurance company’s financial strength, performance and risk profile Target Audience This course is designed for analysts, regulators and insurance personnel who have limited or no experience in the interpretation and analysis of insurance company financial statements.

MEASURING FINANCIAL SOUNDNESS OF INSURANCE COMPANIES

CHAPTER4 REVIEW OF LITERATURE RESEARCH METHODOLOGY

INSURANCE INDUSTRY FINANCIAL DATA – DEVELOPMENT, ANALYSIS AND PRODUCTION Robert R. Lorentzen, A.M. Best Company The Data Services group of the A. M. Best

STRATEGIC FINANCIAL MANAGEMENT IN A GENERAL

Financial Regulations for Insurance Companies

insurance field, companies routinely issue contracts where a claim may not be made for 40 or 50 years in the future, and yet it is clear, since the company has undertaken an obligation, that some sort of liability should be reported when the contract is issued.

The financial performance of life insurance companies in

THE DETERMINANTS OF FINANCIAL PERFORMANCE IN GENERAL

Analysis and Valuation of Insurance Companies Request PDF